Budgeting and saving money are an essential part of financial planning. Whether you are saving up for a big purchase or trying to pay off debt, it is important to have a budget in place and stick to it. Luckily, there are many websites out there that can help you with budgeting and saving money. In this article, we will discuss the top 10 websites for budgeting and saving money, their pros and cons, and why they are the best.

1. Mint.com

Mint.com is a popular budgeting website that allows you to track your spending, set budgets, and get personalized savings tips. It is free to use and is easy to set up. Mint.com also offers a mobile app for convenience.

Pros:

- Easy to use

- Free to use

- Offers personalized savings tips

- Mobile app available

Cons:

- Ads may be annoying

- Limited investment tracking options

Why it's the best:

Mint.com is the best budgeting website for beginners because it is easy to use and free. It also offers personalized savings tips to help you save money.

Fact:

Mint.com was launched in 2006 and has over 20 million users.

People also ask:

- Is Mint.com secure?

- Does Mint.com offer investment tracking?

- How does Mint.com make money?

Answer:

- Yes, Mint.com is secure. It uses bank-level encryption to protect your information.

- Yes, Mint.com offers investment tracking.

- Mint.com makes money by offering users financial products such as credit cards and loans.

2. Personal Capital

Personal Capital is a budgeting website that offers investment tracking, retirement planning, and financial advice. It is free to use but also offers paid services for those who want more personalized financial advice.

Pros:

- Offers investment tracking and retirement planning

- Provides personalized financial advice

- Offers free and paid services

Cons:

- Limited budgeting features

- May be overwhelming for beginners

Why it's the best:

Personal Capital is the best budgeting website for investors because it offers investment tracking and retirement planning. It also provides personalized financial advice.

Fact:

Personal Capital has over 2 million registered users.

People also ask:

- Is Personal Capital safe?

- How does Personal Capital make money?

- What are the fees for Personal Capital's paid services?

Answer:

- Yes, Personal Capital is safe. It uses bank-level encryption to protect your information.

- Personal Capital makes money by offering paid services and by earning a commission on investments it recommends.

- The fees for Personal Capital's paid services range from 0.49% to 0.89% of assets under management.

3. YNAB

YNAB, which stands for You Need a Budget, is a budgeting website that focuses on helping users live within their means. It offers budgeting tools, goal-setting features, and educational resources. YNAB also offers a mobile app for convenience.

Pros:

- Focuses on living within your means

- Offers educational resources

- Mobile app available

- May be too restrictive for some users

- Monthly subscription fee

Why it's the best:

YNAB is the best budgeting website for those who want to focus on living within their means. It also offers educational resources to help users improve their financial literacy.

Fact:

YNAB was founded in 2004 by Jesse Mecham.

People also ask:

- How much does YNAB cost?

- Does YNAB offer investment tracking?

- Is YNAB easy to use?

Answer:

- YNAB costs $11.99 per month or $84 per year.

- No, YNAB does not offer investment tracking.

- YNAB can be challenging to use at first, but it offers a lot of support and educational resources to help users get started.

4. EveryDollar

EveryDollar is a budgeting website that follows the principles of zero-based budgeting, which means that every dollar is assigned a job in your budget. It offers budgeting tools, goal-setting features, and debt payoff planning.

Pros:

- Follows zero-based budgeting principles

- Offers debt payoff planning

- Mobile app available

Cons:

- No free version

- Limited investment tracking options

Why it's the best:

EveryDollar is the best budgeting website for those who want to follow zero-based budgeting principles. It also offers debt payoff planning to help users get out of debt faster.

Fact:

EveryDollar was created by Dave Ramsey, a popular personal finance guru.

People also ask:

- How much does EveryDollar cost?

- Does EveryDollar offer investment tracking?

- Is EveryDollar secure?

Answer:

- EveryDollar costs $129.99 per year for the paid version.

- No, EveryDollar does not offer investment tracking.

- Yes, EveryDollar is secure. It uses bank-level encryption to protect your information.

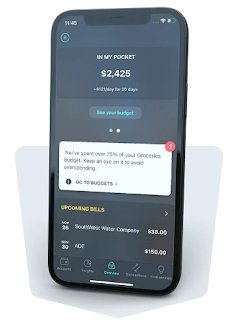

5. PocketGuard

PocketGuard is a budgeting website that focuses on helping users save money. It offers budgeting tools, savings goals, and personalized savings tips. PocketGuard also offers a mobile app for convenience.

Pros:

- Focuses on saving money

- Offers personalized savings tips

- Mobile app available

Cons:

- Limited investment tracking options

- Monthly subscription fee for premium version

Why it's the best:

PocketGuard is the best budgeting website for those who want to focus on saving money. It also offers personalized savings tips to help users save even more.

Fact:

PocketGuard was founded in 2013 and has over 2 million users.

People also ask:

- How much does PocketGuard cost?

- Does PocketGuard offer investment tracking?

- Is PocketGuard easy to use?

Answer:

- PocketGuard costs $3.99 per month or $34.99 per year for the premium version.

- PocketGuard offers limited investment tracking options.

- Yes, PocketGuard is easy to use. It has a simple and intuitive interface.

6. Goodbudget

Goodbudget is a budgeting website that follows the envelope budgeting method, which means that users allocate their money into virtual envelopes for different spending categories. It offers budgeting tools, savings goals, and debt payoff planning.

Pros:

- Follows envelope budgeting method

- Offers debt payoff planning

- Mobile app available

Cons:

- Limited investment tracking options

- Monthly subscription fee for premium version

Why it's the best:

Goodbudget is the best budgeting website for those who want to follow the envelope budgeting method. It also offers debt payoff planning to help users get out of debt faster.

Fact:

Goodbudget was formerly known as the Easy Envelope Budget Aid (EEBA) and was founded in 2009.

People also ask:

- How much does Goodbudget cost?

- Does Goodbudget offer investment tracking?

- Is Goodbudget secure?

Answer:

- Goodbudget costs $7 per month or $60 per year for the premium version.

- Goodbudget offers limited investment tracking options.

- Yes, Goodbudget is secure. It uses bank-level encryption to protect your information.

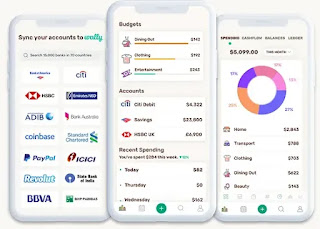

7. Wally

Wally is a budgeting website that offers a simple and intuitive interface. It allows users to track their spending, set budgets, and get personalized savings tips. Wally also offers a mobile app for convenience.

Pros:

- Simple and intuitive interface

- Offers personalized savings tips

- Mobile app available

Cons:

- Limited investment tracking options

- No debt payoff planning features

Why it's the best:

Wally is the best budgeting website for those who want a simple and easy-to-use interface. It also offers personalized savings tips to help users save more money.

Fact:

Wally was founded in 2013 and has over 2 million users.

People also ask:

- Is Wally free?

- Does Wally offer investment tracking?

- Can Wally sync with bank accounts?

Answer:

- Yes, Wally is free to use.

- Wally offers limited investment tracking options.

- Yes, Wally can sync with bank accounts to automatically track expenses.

9. Mvelopes

Mvelopes is a budgeting website that follows the envelope budgeting method. It offers budgeting tools, savings goals, and debt payoff planning. Mvelopes also offers a mobile app for convenience.

Pros:

- Follows envelope budgeting method

- Offers debt payoff planning

- Mobile app available

Cons:

- Limited investment tracking options

- Monthly subscription fee for premium version

Why it's the best:

Mvelopes is the best budgeting website for those who want to follow the envelope budgeting method. It also offers debt payoff planning to help users get out of debt faster.

Fact:

Mvelopes was founded in 2004 and has over 1 million users.

People also ask:

- How much does Mvelopes cost?

- Does Mvelopes offer investment tracking?

- Is Mvelopes secure?

Answer:

- Mvelopes costs $6 per month or $59.99 per year for the premium version.

- Mvelopes offers limited investment tracking options.

- Yes, Mvelopes is secure. It uses bank-level encryption to protect your information.

10. Honeyfi

Honeyfi is a budgeting website designed for couples. It allows couples to track their expenses, set budgets, and save money together. Honeyfi also offers a mobile app for convenience.

Pros:

- Designed for couples

- Allows couples to track expenses and set budgets together

- Mobile app available

Cons:

- Limited investment tracking options

- No debt payoff planning features

Why it's the best:

Honeyfi is the best budgeting website for couples who want to manage their finances together. It allows couples to track their expenses and set budgets together, which can help improve communication and reduce money-related stress.

Fact:

Honeyfi was founded in 2016 and has over 100,000 users.

People also ask:

- How much does Honeyfi cost?

- Can Honeyfi sync with bank accounts?

- Is Honeyfi secure?

Answer:

- Honeyfi costs $9.99 per month for the premium version.

- Yes, Honeyfi can sync with bank accounts to automatically track expenses.

- Yes, Honeyfi is secure. It uses bank-level encryption to protect your information.

Tips for Budgeting and Saving Money

- Create a budget and stick to it.

- Track your expenses to identify areas where you can cut back.

- Set financial goals and create a plan to achieve them.

- Automate your savings by setting up automatic transfers to a savings account.

- Look for ways to reduce your expenses, such as negotiating bills or switching to a cheaper provider.

- Avoid impulse purchases by waiting 24 hours before making a purchase.

- Consider using cash instead of credit cards to avoid overspending.

- Use coupons, discounts, and cashback apps to save money on purchases.

- Shop around for the best deals before making a purchase.

- Avoid lifestyle inflation by avoiding unnecessary expenses when your income increases.

- H5: Pricing for Budgeting Websites

Most budgeting websites are free to use, but some offer premium features for a fee. Premium features may include more advanced budgeting tools, investment tracking, and personalized advice.

Here is a breakdown of the pricing for the budgeting websites listed above:

- Mint: Free

- YNAB: $11.99 per month or $84 per year

- PocketGuard: Free or $3.99 per month for premium version

- Goodbudget: Free or $7 per month or $60 per year for premium version

- EveryDollar: Free or $129.99 per year for premium version

- Personal Capital: Free, but minimum investment of $100,000 for investment management services

- Wally: Free

- Mvelopes: $6 per month or $59.99 per year for premium version

- Honeyfi: $9.99 per month for premium version

Overall, there are plenty of budgeting websites available to help you manage your finances and save money. Whether you're looking for a simple budgeting tool or a more comprehensive financial management platform, there is an option out there for you. Consider your specific needs and preferences when choosing a budgeting website, and don't be afraid to try out a few different options to find the one that works best for you.

.webp)

Comments

Post a Comment